Thierry Blayac and Patrice Bougette (2023), « What can be expected from mergers after deregulation ? The case of the long-distance bus industry in France», Review of Industrial Organization, vol. 62(1), pp. 63-97.

- Context and issues

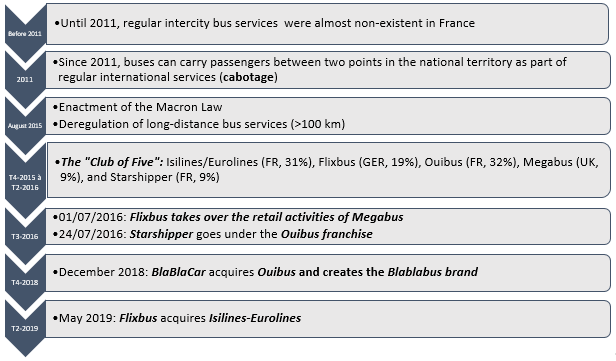

In France, the law “for growth, activity, and equality of economic opportunities”, more commonly known as the Macron Law, was enacted on 6 August 2015. In its transport section, its ambition is to promote the long-distance mobility of certain categories of the population (young people, older people, people on low incomes) by liberalizing regular transport by bus, thus sharing in a logic of inclusive mobility. Unlike most of its European neighbors where such transport services already existed (Spain, Italy, Germany, for example), France did not make this choice to meet the long-distance mobility needs of its fellow citizens until very recently. Thus, regular long-distance bus services were non-existent before 2011 and only appeared in the context of international cabotage from 2011. The abovementioned law put an end to this situation by completely deregulating regular long-distance bus services (>100 km) in France. In less than ten years, the market has therefore evolved significantly, as shown in Figure 1, which presents the main stages of the process of deregulation and opening up to competition.

Figure 1 : The main steps in the deregulation of long-distance bus services

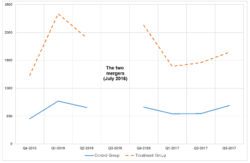

In the context of the deregulation and opening to competition of this market, most of the dictates of the theoretical models have been observed: entry of competitors, price wars, and increase in the quality of services. This phase quickly gave way to a phase of market consolidation with a first wave of horizontal mergers between operators less than a year after opening (3rd quarter 2016), then a second, more diffuse one (4th quarter 2018 – 2nd quarter 2019). These merger operations can lead to two types of expected effects that are part of the competition assessment that the competition authorities must carry out when they are notified of an operation. Either pro-competitive effects (e.g. the emergence of efficiency gains that can be passed on to consumers through lower prices, greater variety and better quality of services), or anti-competitive effects (higher prices, less variety and quality of services); more problematic for the authorities.

The purpose of the article, quoted in reference, is to study the pro- or anti-competitive impact of the two mergers between operators (Flixbus/Megabus and Ouibus/Starshipper) that took place during the first wave of consolidation in 2016. Beyond the legitimate interest that every economist has in the study of horizontal mergers, those studied in this article are of specific interest for at least three reasons : (i)- the business model used by the operators is based on a two-sided market (digital platform), encouraging rapid growth at the start of the life cycle, de facto escaping the threshold of notification to the competent competition authorities; (ii)- the development of inclusive long-distance mobility could be destroyed by concentrations between operators; (iii)- long-distance mobility, whose sustainability could be called into question.

Thus, in our study, the effects on the average revenue per passenger (€/100km), the average occupancy rate, or the average frequencies of long-distance bus services, are the indicators retained in order to understand the pro- or anti-competitive impact of planned mergers.

- Data and methodology used

As part of the process of the deregulation and opening to competition of long-distance bus services, the legislator has expressly provided for data feedback (quarterly and annual) from operators to the French transport regulator, the Autorité de Régulation des Transports (ART), formerly ARAFER. We relied on this quarterly data feedback to build our database. We thus have eight consecutive quarters of market monitoring. The available data were reworked and specific variables generated in order to answer our research question. We thus place ourselves at the level of the lines and not at the level of the operators, in order to assess the global impact of mergers on variables of interest.

The empirical strategy implemented uses the double difference method, which consists in evaluating the impact of a treatment (here the merger between the operators) by comparing the effects between a treatment group and a control group, before and after the introduction of the treatment. It is a robust quasi-experimental method that is widely used to evaluate a public policy. In our case, the treatment can be assimilated into the operations of mergers between operators, which occurred in the third quarter of 2016. We thus have three quarters of observation before the treatment and four quarters after this. Identification of a control group and a treatment group required specific work in order to identify the lines for which we had information for the seven quarters that were needed to implement the double difference method[1]. The treatment group includes lines in which at least one merger between operators has taken place (either Flixbus/Megabus, or Ouibus/Starshipper). The control group consists of lines for which another operator is present (for example Isilines-Eurolines) or lines for which only one of the two merging entities is present (Ouibus ou Starshipper, Flixbus or Megabus). This procedure identifies 168 lines within the control group and 89 lines in the treatment group. The two groups cover 90% of passengers transported during the three quarters preceding the two mergers.

- Results obtained

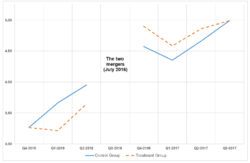

The study carried out highlights the unambiguous effects on passenger revenue (€/100km). Thus, the operations of horizontal mergers between operators are behind a significant increase in the average revenue per passenger immediately after the merger (+13.5%), but which decreases over time (+5.3% four quarters after the merger). Such mergers could therefore be considered anti-competitive by the competition authorities.

(a) Average revenue per passenger (€/100km)

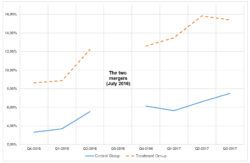

(b) Average occupancy rate (%)

(c) Average frequencies (#/quarter)

Figure 2 : Pre- and post-merger evolution within the control group and the treatment group

As shown in Figure 2, the occupancy rate of buses is not affected by merger operations between the operators. The parallel evolution of the treatment group and the control group simply reflects the natural trend and the greater maturity of the market from this point of view[2].

In terms of frequencies offered, mergers between operators generate a net reduction in frequencies offered (between -21.5% and -25.7% depending on the quarter) but this does not occur immediately after the merger. This reduction in the supply of services can also be assimilated into anti-competitive effects.

The analysis carried out also makes it possible to distinguish the effects according to the identity of the two operations, one having had a positive effect on the occupancy rate, and

this over all the four quarters studied (which shows a certain efficiency), while the other finally reduced the occupancy rate, but only in the first two post-merger quarters.

In the treatment group, timetable frequency decreased significantly (-28.71 %) and, as mentioned earlier, occupancy rates increased significantly. This is in line with the phenomena of rationalization and market maturity. Timetable frequencies also decreased in the control group (-19.92 %), and the occupancy rate increased, but to a lesser extent than the decrease in frequencies. This shows that the two mergers directly affected frequencies downwards, with a one quarter lag.

These results indicate that, in 2016, the market was not yet sufficiently mature and that bus operators were probably, through mergers, seeking the critical size from which they would become profitable. Since then the most recent acquisitions confirmed this trend: at the beginning of 2020, a duopoly emerged between BlaBlaBus and FlixBus. The strength of intermodal competition is then a major challenge for the further development of the long-distance bus market.

[1] Since the mergers took place in the 3rd quarter of 2016, we have chosen to neutralize the resulting data.

[2] For technical reasons related to the methodology used in our study, the definition of the occupancy rate does not correspond to that used by the ART in its annual reports.